The average fixed cost can be defined as the total fixed cost divided by total units output.

So, for example, with two barbers the total cost is: $160 + $160 = $320. Adding together the fixed costs in the third column and the variable costs in the fourth column produces the total costs in the fifth column.

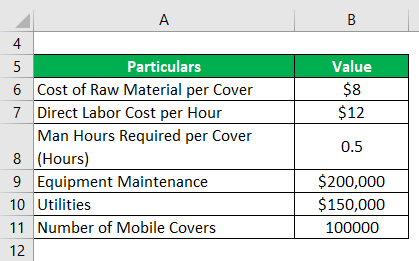

Total cost For example, two barbers cost: 2 × $80 = $160. Also read: What is materiality accounting & 5 practical examples. Average Fixed Cost (AFC) = FC/Q = ATC – AVC. Fixed costs are the costs incurred regardless of the volume of goods produced. Average fixed cost is the fixed cost of production divided by the number of goods produced. The breakeven point in a business is the point at which a business begins to. Here are some reasons why companies use average fixed cost: Measure breakeven. Average fixed cost = average total cost - average variable cost. Paying for an office or retail space will be a sizeable portion of your fixed.

By performing variable cost analysis, a company will better grasp the inputs for its products and what it needs to collect in revenue per unit to make sure its earning money. Some of the examples of variable costs include: The costs increase as the volume of activities increases and decrease as the volume of activities decreases. In other words, they are costs that vary depending on the volume of activity. A variable cost is a corporate expense that changes in proportion to production output.

CALCULATE TOTAL VARIABLE COST HOW TO

Ahead of discussing how to calculate variable cost, let us define it.

0 kommentar(er)

0 kommentar(er)